Mortgage Rate Calculator

Many prospective homeowners applying for actend to have two concerns before they agree to sign: How much interest will I end up paying, and can I afford the monthly payments?Unless you're a robot or mathematical savant, chances are you won't be able to calculate these figures off the top of your head. Luckily, programmers have developed several mortgage calculators over the years that help you quickly and easily answer these questions.

But how do you use these calculators correctly, and to what end? Are all mortgage calculators created equal?

Commonly Used Terms

Mortgage calculators don't always use the same language. It's very possible you'll see multiple ways of describing the same thing. For example, one calculator might have a space for "APR" while another asks for the mortgage's "interest rate," when in fact these two terms mean the same.Here's a brief list of the three core elements all mortgage calculators have:

- Rate/interest rate/APR – This is how much interest accrues on your mortgage each year. Most times the calculator will ask you to enter this amount as a percentage and not a decimal, unless it specifies otherwise. For example, if you have an interest rate of 4.25%, enter "4.25" instead of "0.0425".

- Principal – This is the face value of your mortgage on day one and represents the total amount of money you haven't repaid yet. If your mortgage is $400,000 on day one, then your principal is $400,000. If you pay $100,000 of that over the next few years, then your principal will be $300,000.

- Mortgage length/number of payments/amortization period – It's assumed that, if you're using a mortgage calculator, you're using it before you take out your mortgage. If that's the case, these terms will be the same. But if you're midway through paying down your mortgage, you would want to find the "number of payments" by subtracting how many you've made from the total expected number of payments. For example, if you have a 30-year mortgage (360 months), but just finished year two (24 months), then you would have 336 payments remaining (assuming your payments are monthly like most mortgages).

- Loan-to-value ratio –This is a measure of the size of the mortgage compared to the home's value and is directly affected by the size of your down payment. If you take out a $160,000 mortgage on a $200,000 home after making a $40,000 down payment, your loan-to-value ratio is 80%.

- Private mortgage insurance (PMI) – Lenders will typically require you to buy if your loan-to-value ratio is more than 80% – your down payment was less than 20% of the purchase price – and will continue to charge you this premium until it dips to 78%.

- Homeowner's insurance – Often bundled with mortgage payments, make sure you know your homeowner's insurance premium every month (or at least make an educated guess if you don't know it yet).

- Adjustments – If you've taken out an adjustable-rate mortgage, adjustments are how many percentage points your interest rate increases/decreases after a pre-determined period.

What Mortgage Calculators Do

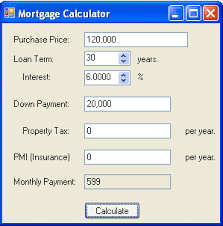

Many would-be homebuyers turn to mortgage calculators to figure out just how much home they can afford.The most common application is finding the estimated monthly payment for your new mortgage. These calculators run complex formulas to account for your principal, interest rate and loan length to determine how much you can expect to pay each month.

Some calculators have features that show you how much interest you'll pay over the life of your mortgage. Unless you're paying for your house entirely in cash upfront, you might be surprised to see just how much more money an APR tacks onto your mortgage over time.

The most complex and detailed mortgage calculators will include variables for real world expenses like PMI, home insurance, property taxes and more. Others will include options for adjustable-rate mortgage changes as well. These can help you fine-tune your personal finance plans even further, and give you a comprehensive picture of financing a home.

How Calculators Can Save You Money

To be fair, lenders are required to abide by federal law and include a Good Faith Estimate and Truth-in-Lending disclosure when you sign for a loan. These documents reveal your mortgage's APR, finance charges, payment schedule and the total price tag of your loan, assuming you make the minimum monthly payments on time and in full.However, if you're seeing all of that information for the first time when you sign the loan, then you haven't done your due diligence.

That's where mortgage calculators come in. They can help you understand the bulk of your financial obligations before you sign for the loan. And while good mortgage lenders won't pressure or coerce you into signing, seeing all that information for the first time right before you sign can be a bit overwhelming.

In addition, these calculators can help you compare the pros and cons of mortgages of lengths, terms and interest rates, to help you develop long-term plans for financing your home.